- India

- International

Four years of Modi government — Finance, Part II: GST on course, noose on black money tightened

Initially proposed features – reverse charge mechanism, invoice matching, tax deduction at source – still in limbo.

Alongside the indirect tax reform, the government also launched steps targeting black money, including a new legislation to tackle the issue of black money stashed abroad. (Representational Image)

Alongside the indirect tax reform, the government also launched steps targeting black money, including a new legislation to tackle the issue of black money stashed abroad. (Representational Image)

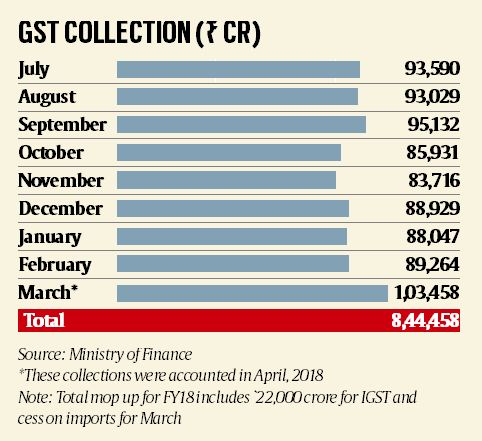

The goods and services tax (GST) regime, touted as the biggest indirect tax reform since Independence, was rolled out in the third year of the NDA government. The transition was marked by initial hiccups, especially on the tech platform supporting the indirect tax. The government responded by suspending some of the initially envisaged features, including GSTR-2 and GSTR-3 forms, reverse charge mechanism, invoice matching and simultaneous roll-out of e-way bill with the GST launch date.

Alongside this, several rounds of rate rationalisation led to uncertainty over both the implementation details and the revenue front. The GST revenues have stabilised now, but further improvement hinges on anti-evasion measures such as reverse charge mechanism and invoice matching.

Read | Four years of Modi government — Finance, Part I: Tax net widened; private funds still elusive

Alongside the indirect tax reform, the government also launched steps targeting black money, including a new legislation to tackle the issue of black money stashed abroad. The Centre also kick-started the phased reduction in corporate tax rate over the last four years.

What’s Done

* Roll-out of GST from July 1, 2017. As many as 17 Central and state taxes were subsumed into the new tax regime. Key decisions were taken by the GST Council, headed by the Union Finance Minister and consisting of state finance ministers as members.

* Enactment of Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015. A one-time compliance window was provided from July 1 to September 30, 2015, for taxpayers to make declarations of their undisclosed foreign assets, under which the undisclosed foreign assets worth over Rs 4,100 crore were declared by over 640 persons.

* Compliance windows were provided for declaration of undisclosed income through the Income Declaration Scheme (IDS) in 2016, followed by Pradhan Mantri Garib Kalyan Yojana (PMGKY) in post-demonetisation phase. Under IDS, disclosures worth Rs 67,300 crore were made by over 71,000 persons, while under PMGKY, disclosures of about Rs 4,900 crore were made by about 21,000 persons.

* The Benami Transactions (Prohibition) Act, 1988, was amended for prohibition of benami transactions. Under this, over 900 cases of properties have been provisionally attached and the value of properties under attachment is over Rs 3,500 crore.

* The Benami Transactions (Prohibition) Act, 1988, was amended for prohibition of benami transactions. Under this, over 900 cases of properties have been provisionally attached and the value of properties under attachment is over Rs 3,500 crore.

* Implementation of General Anti-Avoidance Rules (GAAR) from April 1, 2017. Amendment of the Double Taxation Avoidance Agreement (DTAA) with Mauritius that gave India the right to tax capital gains arising from sale or transfer of shares of an Indian company acquired by a Mauritian tax resident and exempted investments made until March 31, 2017.

* The tax net widened during FY18 with the number of new ITR filers rising to 99.49 lakh (as on March 30, 2018), 16.3 per cent higher than 85.51 lakh new ITR filers added in 2016-17 fiscal.

What’s in Progress

* A new GST return filing system has been approved and will take about a year to come through. All taxpayers, except composition dealers and dealers with nil transactions, will be required to file one monthly return and a three-stage transition period has been proposed, after which input tax credit will be provided only on the seller-uploaded invoices.

* Under GST, the government has introduced the mandatory roll-out of e-way bill for inter-state movement of goods. At intra-state level, the e-way bill system is being introduced in a staggered manner but all states would be required to ensure mandatory roll-out from June 3. So far, 20 states/UTs have made e-way bill mandatory.

Also Read | Four years of Modi government — Railways: Reforms on track, revenue a worry

* Operation Clean Money launched by I-T department on January 31, 2017, to analyse the data of the persons who deposited large sums of cash after demonetisation. About 17.92 lakh persons identified for verification in the first phase. The second phase involved categorisation of taxpayers in clusters of high, medium and low risk.

* Constitution of a task force for drafting a new direct tax legislation. The panel is expected to submit a report in the next three months.

* The government cleared refunds to exporters under GST but the count is still not 100 per cent. As on March 31, Rs 17,616 crore was sanctioned.

What’s Stuck

* Under GST, a majority of states is yet to set up an appellate authority. So far, 12 states have issued a notification to set up an Appellate Authority for Advance Ruling (AAAR). Also, the proposed e-wallet for exporters, which has been suspended till October, is still in the works.

* The GST Council in its last meeting this month proposed levying cess on sugar and providing incentives for digital payments. The proposals, however, have met with opposition from states, following which two GoMs have been formed.

* The GST Council in its last meeting this month proposed levying cess on sugar and providing incentives for digital payments. The proposals, however, have met with opposition from states, following which two GoMs have been formed.

* The government first lowered corporate tax rate to 25 per cent from 30 per cent in the Union Budget for 2017-18 for companies with a turnover of Rs 50 crore, then extended it for companies with an annual turnover of up to Rs 250 crore this fiscal, but it has not been extended for all companies as was proposed in 2015.

* Five petroleum products — crude oil, diesel, petrol, natural gas, aviation turbine fuel, alcohol for human consumption and real estate are still out of the GST ambit, resulting in a cascading effect for many related products.

* The initially proposed features of GST — reverse charge mechanism, where the tax liability lies on the buyer in case of unregistered seller, invoice matching and tax deduction at source/tax collected at source are still in limbo and are expected to boost compliance and check evasion once they come into effect.

***

Also read | Four years of Modi government — Education: Warming up after initial slumber

Hasmukh Adhia

Hasmukh Adhia

Hasmukh Adhia, Finance & Revenue Secretary: “The most important achievement of Revenue Department is the major structural reform of implementing uniform GST for the entire country. This reform will bring rich dividend to the country in the form of greater revenue and higher GDP growth rate also.”

The opposition view

Thomas Isaac

Thomas Isaac

Thomas Isaac, Finance Minister, Kerala: “The reasons why GST revenues are below expectations is the tax’s shabby implementation… Now one year into the tax regime, we are debating about (a new) return form. We haven’t finalised the form yet. It’s going to take another six months and we are still collecting tax on the basis of self-declared forms. There is no scrutiny taking place, no mechanism in place to do that.”

Apr 24: Latest News

- 01

- 02

- 03

- 04

- 05