Are Oversupply Concerns Gripping Natural Gas Prices?

On November 22, natural gas (UNG)(BOIL) January 2018 futures closed at a discount of ~$0.2 to January 2019 futures.

Nov. 23 2017, Updated 5:45 p.m. ET

Futures spread

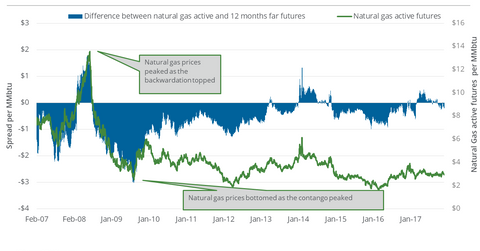

On November 22, natural gas (UNG)(BOIL) January 2018 futures closed at a discount of ~$0.2 to January 2019 futures. This difference could be called the “futures spread.” On November 15, the future spread was at a discount of $0.08. For November 15–22, natural gas futures fell 3.8%.

What are the futures spread discount and premium?

Any rise in the discount could cause downside or threaten natural gas’s gains. On March 3, 2016, natural gas futures plunged to a 17-year-low closing price, and the discount reached $0.84. But if the discount falls, natural gas prices could find support.

On the other hand, a rise in the premium could add upside to natural gas prices. On May 12, natural gas futures were at their highest closing price of 2017, and the premium reached $0.5. But if the premium falls, it could threaten natural gas’s gains.

In the seven calendar days up to November 22, the discount expanded and natural gas prices fell. So concerns surrounding natural gas supplies could be rising. In Parts 1 and 2 of this series, we already analyzed natural gas prices and the factors that could cause natural gas supplies to rise.

Energy sector

US natural gas producers (XOP)(DRIP)(IEO) may hedge their output prices based on the natural gas futures forward curve. This curve could also impact midstream natural gas transportation, storage, and processing companies (AMLP).

On November 22, natural gas February 2018 futures closed ~$0.005 above the January 2018 futures. This price difference could erode the gains of ETFs like the ProShares Ultra Bloomberg Natural Gas (BOIL) and the United States Natural Gas Fund LP (UNG) because they invest in natural gas futures.