Alamos Gold Reports Mineral Reserves and Resources for the Year-Ended 2024

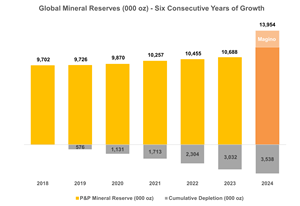

Global Mineral Reserves Increase 31% Driven by the Addition of Magino, and a 32% Increase in Mineral Reserves at Island Gold at 11% Higher Grades

/EIN News/ -- All amounts are in United States dollars, unless otherwise stated.

TORONTO, Feb. 18, 2025 (GLOBE NEWSWIRE) -- Alamos Gold Inc. (TSX:AGI; NYSE:AGI) (“Alamos” or the “Company”) today reported its updated Mineral Reserves and Resources as of December 31, 2024. For a detailed summary by asset, refer to the tables below.

Highlights

-

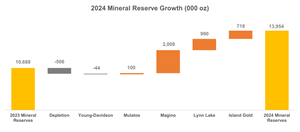

Global Proven and Probable Mineral Reserves increased 31% to 14.0 million ounces of gold (298 million tonnes (“mt”) grading 1.45 grams per tonne of gold (“g/t Au”)), driven by the acquisition of Magino in 2024, continued high-grade additions at Island Gold, and an initial Mineral Reserve at Burnt Timber and Linkwood

- Excluding Magino, Proven and Probable Reserves increased 12% to 11.9 million ounces of gold (230 mt grading 1.62 g/t Au) reflecting continued exploration success. Mineral Reserve additions more than replaced depletion at a rate of 249% (646% including Magino)

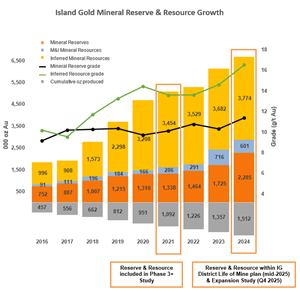

- Island Gold’s Mineral Reserves increased 32% to 2.3 million ounces with grades increasing 11% to 11.40 g/t Au (6.2 mt), driven by significantly higher-grade additions across the main structure

- Burnt Timber and Linkwood initial Mineral Reserve of 0.9 million ounces (30.7 mt grading 0.95 g/t Au) reflecting the successful conversion of Mineral Resources

- Magino Mineral Reserve of 2.0 million ounces (68.4 mt grading 0.91 g/t Au), consistent with internal estimates completed ahead of the acquisition in 2024

- Island Gold’s Mineral Reserves and Resources increased 9% to 6.7 million ounces at substantially higher grades, including an 11% increase in Mineral Reserve grades to 11.40 g/t Au, and 13% increase in Inferred Mineral Resources grades to 16.52 g/t Au

- Island Gold District Life of Mine plan will incorporate the significant growth since the Phase 3+ Expansion Study, with the increase in grades expected to support higher average annual gold production from Island Gold over the longer-term. The Life of Mine plan (incorporating Island Gold and Magino) is expected to be released mid-2025, with an Expansion Study expected to follow in the fourth quarter

- Global Measured and Indicated Mineral Resources increased 50% to 6.6 million ounces of gold (181 mt grading 1.13 g/t Au), primarily reflecting the acquisition of Magino. Excluding Magino, Measured and Indicated Mineral Resources increased 6% to 4.7 million ounces of gold, reflecting additions at Burnt Timber and Linkwood, and an initial Mineral Resource at Cerro Pelon Underground

-

Global Inferred Mineral Resources decreased 2% to 7.1 million ounces of gold (125 mt grading 1.76 g/t Au), with the successful conversion of Mineral Resources to Reserves at Burnt Timber and Linkwood largely offset by the addition of Magino, and growth at Island Gold

-

Gold price assumption of $1,600 per ounce used for estimating Mineral Reserves and $1,800 per ounce for estimating Mineral Resources, up from $1,400 and $1,600 per ounce, respectively in 2023, reflecting the significantly higher gold price environment. Both remain conservative relative to the three-year trailing average gold price of approximately $2,044 per ounce

- Global exploration budget of $72 million in 2025, the largest in the Company’s history supporting broad based success across its asset base with expanded budgets at the Island Gold District and the Qiqavik project in Quebec

“Our significant investment in exploration continues to drive value across our asset base with another substantial increase in Mineral Reserves, marking the sixth consecutive year of growth. This included an initial Mineral Reserve at Burnt Timber and Linkwood, and continued growth at PDA supporting new, high-return projects. We also delivered another year of growth at Island Gold, at considerably higher Reserve and Resource grades. This growth and increase in grades will form the basis for the Island Gold District Life of Mine Plan and Expansion Study to be released later this year. We expect both will outline a larger, and significantly more valuable operation,” said John A. McCluskey, President and Chief Executive Officer.

| Proven and Probable Gold Mineral Reserves | |||||||||

| 2024 | 2023 | % Change | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | (000’s) | (g/t Au) | (000’s) | |

| Island Gold | 6,232 | 11.40 | 2,285 | 5,210 | 10.30 | 1,725 | 20% | 11% | 32% |

| Magino | 68,400 | 0.91 | 2,008 | - | - | - | |||

| Young-Davidson | 41,756 | 2.26 | 3,030 | 43,911 | 2.31 | 3,261 | -5% | -2% | -7% |

| La Yaqui Grande | 7,710 | 1.34 | 331 | 11,318 | 1.33 | 483 | -32 | 1% | -31% |

| Puerto Del Aire | 6,050 | 5.45 | 1,060 | 5,375 | 5.61 | 969 | 13% | -3% | 9% |

| Total Mulatos | 13,760 | 3.14 | 1,391 | 16,693 | 2.71 | 1,452 | -18% | 16% | -4% |

| MacLellan | 39,379 | 1.35 | 1,711 | 39,738 | 1.34 | 1,717 | -1% | 1% | - |

| Gordon | 10,006 | 2.09 | 671 | 7,873 | 2.43 | 615 | 27% | -14% | 9% |

| Burnt Timber | 14,352 | 1.02 | 469 | - | - | - | |||

| Linkwood | 16,318 | 0.90 | 472 | - | - | - | |||

| Total Lynn Lake | 80,056 | 1.29 | 3,322 | 47,610 | 1.52 | 2,332 | 68% | -15% | 42% |

| Ağı Dağı | 54,361 | 0.67 | 1,166 | 54,361 | 0.67 | 1,166 | |||

| Kirazlı | 33,861 | 0.69 | 752 | 33,861 | 0.69 | 752 | |||

| Total Türkiye | 88,222 | 0.68 | 1,918 | 88,222 | 0.68 | 1,918 | - | - | - |

| Alamos – Total | 298,425 | 1.45 | 13,954 | 201,647 | 1.65 | 10,688 | 48% | -12% | 31% |

| Measured and Indicated Gold Mineral Resources (exclusive of Mineral Reserves) | |||||||||

| Island Gold | 2,113 | 8.76 | 601 | 2,552 | 8.73 | 716 | -16% | 0% | -16% |

| Magino | 62,689 | 0.94 | 1,905 | - | - | - | - | - | - |

| Young-Davidson – Surface | 1,739 | 1.24 | 69 | 1,739 | 1.24 | 69 | |||

| Young-Davidson – Underground | 11,114 | 3.13 | 1,117 | 9,914 | 3.32 | 1,057 | 12% | -6% | 6% |

| Total Young-Davidson | 12,852 | 2.87 | 1,186 | 11,653 | 3.01 | 1,127 | 10% | -5% | 5% |

| Golden Arrow | 6,442 | 1.19 | 246 | 6,442 | 1.19 | 246 | - | - | - |

| Mulatos Mine | 6,722 | 0.98 | 214 | 7,083 | 1.13 | 258 | -4% | -13% | -17% |

| La Yaqui Grande | 1,523 | 0.78 | 38 | 1,073 | 0.87 | 30 | 42% | -11% | 27% |

| Puerto Del Aire | 2,403 | 3.49 | 269 | 2,106 | 3.54 | 240 | 14% | -2% | 12% |

| Cerro Pelon | 720 | 4.49 | 104 | - | - | - | |||

| Carricito | 1,355 | 0.83 | 36 | 1,355 | 0.83 | 36 | |||

| Total Mulatos | 12,772 | 1.61 | 661 | 11,617 | 1.51 | 564 | 10% | 7% | 17% |

| Lynn Lake | 16,189 | 1.13 | 587 | 7,848 | 1.37 | 345 | 106% | -17% | 70% |

| Türkiye | 55,664 | 0.60 | 1,068 | 55,664 | 0.60 | 1,068 | - | - | - |

| Quartz Mountain | 12,156 | 0.87 | 339 | 12,156 | 0.87 | 339 | - | - | - |

| Alamos – Total | 180,897 | 1.13 | 6,594 | 107,932 | 1.27 | 4,405 | 68% | -11% | 50% |

| Inferred Gold Mineral Resources | |||||||||

| Island Gold | 7,106 | 16.52 | 3,774 | 7,857 | 14.58 | 3,682 | -10% | 13% | 2% |

| Magino | 40,383 | 0.91 | 1,177 | - | - | - | - | - | - |

| Young-Davidson – Surface | 31 | 0.99 | 1 | 31 | 0.99 | 1 | |||

| Young-Davidson – Underground | 1,880 | 3.25 | 197 | 1,350 | 3.31 | 144 | 39% | -2% | 37% |

| Total Young-Davidson | 1,911 | 3.22 | 198 | 1,381 | 3.26 | 145 | 38% | -1% | 37% |

| Golden Arrow | 2,028 | 1.07 | 70 | 2,028 | 1.07 | 70 | - | - | - |

| Mulatos Mine | 641 | 0.91 | 19 | 571 | 0.92 | 17 | 12% | 0% | 12% |

| La Yaqui Grande | 74 | 1.74 | 4 | 107 | 1.30 | 4 | -31% | 33% | 0% |

| Puerto Del Aire | 281 | 4.07 | 37 | 73 | 5.97 | 14 | 285% | -32% | 163% |

| Carricito | 900 | 0.74 | 22 | 900 | 0.74 | 22 | |||

| Total Mulatos | 1,896 | 1.34 | 82 | 1,651 | 1.07 | 57 | 15% | 25% | 43% |

| Lynn Lake | 5,682 | 0.94 | 171 | 48,685 | 1.09 | 1,699 | -88% | -14% | -90% |

| Türkiye | 27,245 | 0.55 | 482 | 27,245 | 0.55 | 482 | - | - | - |

| Quartz Mountain | 39,205 | 0.91 | 1,147 | 39,205 | 0.91 | 1,147 | - | - | - |

| Alamos – Total | 125,455 | 1.76 | 7,100 | 128,052 | 1.77 | 7,282 | -2% | 0% | -2% |

Mineral Reserves

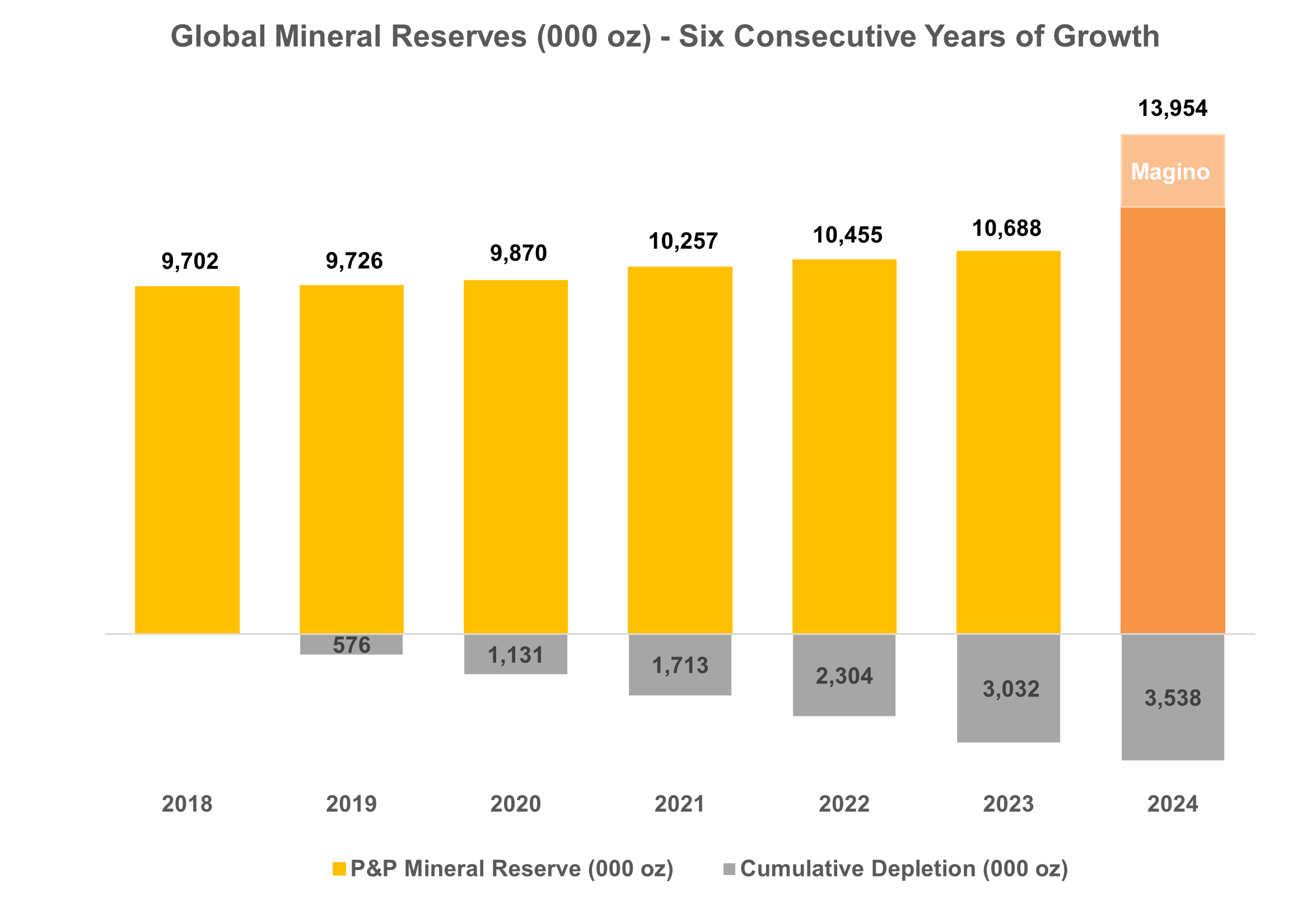

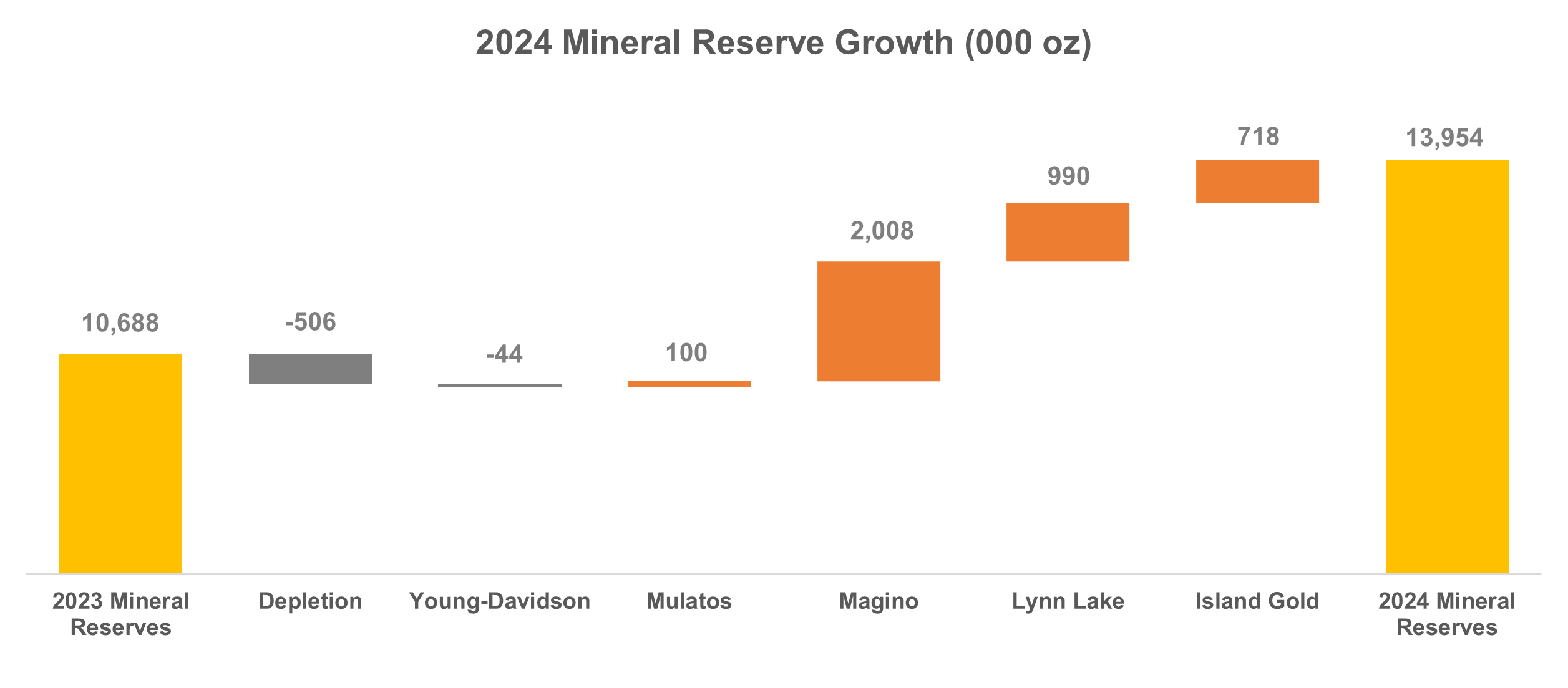

Global Proven and Probable Mineral Reserves total 14.0 million ounces of gold as of December 31, 2024, a 31% increase from 10.7 million ounces at the end of 2023. The increase reflects the addition of the Magino mine, which was acquired in July 2024, as well as further high-grade additions at Island Gold, and an initial Mineral Reserve at Burnt Timber and Linkwood. Grades decreased 12% to 1.45 g/t Au reflecting the addition of relatively lower grade Mineral Reserves from Magino and Burnt Timber and Linkwood, partially offset by growth in significantly higher-grade Mineral Reserves at Island Gold.

Excluding Magino, Global Proven and Probable Reserves increased 12%, or 1.3 million ounces to 11.9 million ounces, net of depletion, at slightly lower grades of 1.62 g/t Au. This was driven by strong ongoing exploration success with additions significantly outpacing mining depletion of 506,000 ounces in 2024. This marked the sixth consecutive year Mineral Reserves have increased for a cumulative increase of 44% (23% excluding the acquisition of Magino).

Island Gold’s strong pace of growth continued with Mineral Reserves increasing 32% to 2.3 million ounces, net of depletion, marking the 12th consecutive year of growth. Grades also increased 11% to 11.40 g/t Au, an impressive outcome given the higher grades mined during 2024, which averaged 12.47 g/t Au. The increase was driven by higher-grade additions across the main structure (C/E1E-zones), particularly in the Island Main and East areas. With the main structure open laterally and at depth, and several recently defined high-grade zones in the hanging wall and footwall, this long-term pace of growth is expected to continue.

Magino’s Mineral Reserve of 2.0 million ounces grading 0.91 g/t Au is consistent with the internally modelled estimate conducted by Alamos prior to the acquisition of Argonaut. This represents a decrease from the 2.3 million ounces grading 1.16 g/t Au reported by the previous owner reflecting more realistic assumptions, including lower capping factors, increased dilution, and smaller areas of influence around higher grade intercepts. Grades mined to date have been consistent with Alamos’ updated block model and Mineral Reserve estimate.

Lynn Lake’s combined Mineral Reserves increased 42% to 3.3 million ounces grading 1.29 g/t Au), driven by the successful conversion of Mineral Resources to Reserves at Burnt Timber and Linkwood. An initial Mineral Reserve was declared at Burnt Timber and Linkwood totaling 0.9 million ounces grading 0.95 g/t Au. Both deposits are expected to be incorporated into the Lynn Lake project as high-return satellite deposits which will serve as a source of additional mill feed (see press release dated February 13, 2025). Mineral Reserves for the MacLellan and Gordon deposits increased slightly to 2.4 million ounces.

Mulatos District Mineral Reserves decreased slightly (61,000 oz), to 1.4 million ounces with mining depletion at La Yaqui Grande largely offset by growth at Puerto Del Aire (“PDA”). Grades increased 16% to 3.14 g/t Au with the higher-grade PDA deposit representing an increasing portion of the Mulatos District’s Mineral Reserves. PDA’s Mineral Reserve increased 9% to 1.1 million ounces with grades largely unchanged at 5.45 g/t Au. Ongoing exploration success at PDA and Cerro Pelon continues to demonstrate the strong potential for growth in higher-grade Mineral Reserves at both deposits, enhancing already strong economics for the PDA project.

Young-Davidson’s Mineral Reserves decreased 7%, or 0.2 million ounces, to 3.0 million ounces grading 2.26 g/t Au, primarily due to mining depletion. The 2025 exploration program is focused on extending mineralization within the Young-Davidson syenite, which hosts the majority of Mineral Reserves and Resources, as well as defining further higher-grade mineralization within the hanging wall.

A detailed summary of Proven and Probable Mineral Reserves as of December 31, 2024, is presented in Table 1 at the end of this press release.

Mineral Resources

Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) increased 50% to 6.6 million ounces, with grades decreasing 11% to 1.13 g/t Au, as of December 31, 2024. The increase in ounces and decrease in grades was driven by the addition of Magino. Excluding Magino, Global Measured and Indicated Mineral Resources (exclusive of Mineral Reserves) increased 6% to total 4.7 million ounces with grades decreasing 3% to 1.23 g/t Au, reflecting additions at the Burnt Timber and Linkwood deposits, and an initial Mineral Resource at Cerro Pelon Underground.

Global Inferred Mineral Resources decreased 2% to total 7.1 million ounces with grades largely unchanged at 1.76 g/t Au, as of December 31, 2024. This reflected the successful conversion of Inferred Mineral Resources at Burnt Timber and Linkwood, which was offset by the inclusion of Magino, and growth at Island Gold.

Detailed summaries of the Company’s Measured and Indicated Mineral Resources and Inferred Mineral Resources as of December 31, 2024, are presented in Tables 3 and 4, respectively, at the end of this press release.

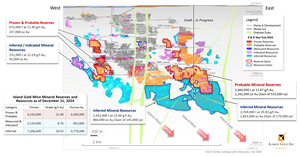

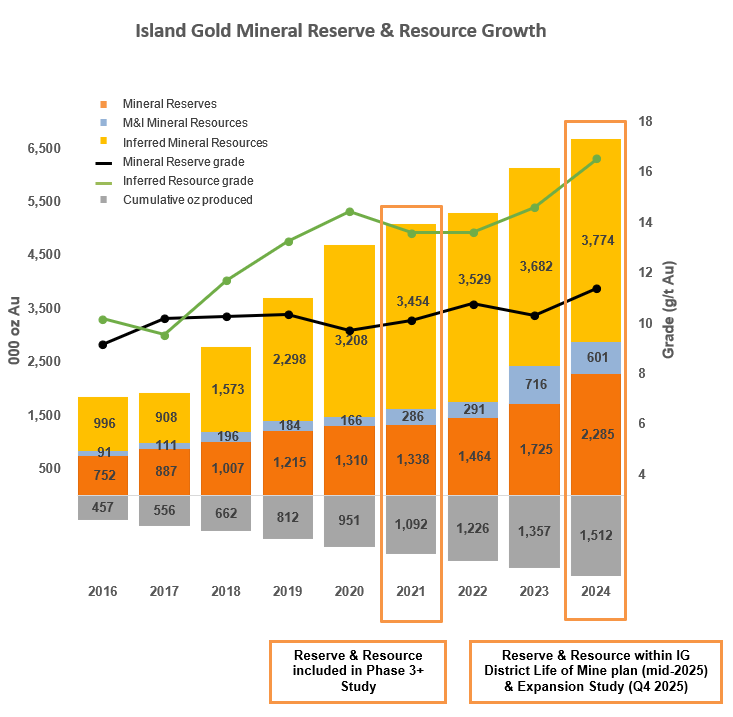

Island Gold

Island Gold’s rapid pace of growth continued with Mineral Reserves and Resources increasing 9% across all categories to 6.7 million ounces, net of depletion. This marked the ninth consecutive year Mineral Reserves and Resources have increased, and at substantially higher grades. Inclusive of mining depletion, over eight million ounces have been discovered to date at Island Gold as it continues to demonstrate itself as one of the highest-grade, and fastest growing deposits in the world.

Mineral Reserves increased 32% to 2.3 million ounces in 2024, net of mining depletion, marking the 12th consecutive year of growth. Grades also increased 11% to 11.40 g/t Au, reflecting substantially higher-grade additions which totaled 718,000 ounces. This significantly outpaced mining depletion, which included higher grades mined in 2024 totaling 157,000 ounces grading 12.47 g/t Au.

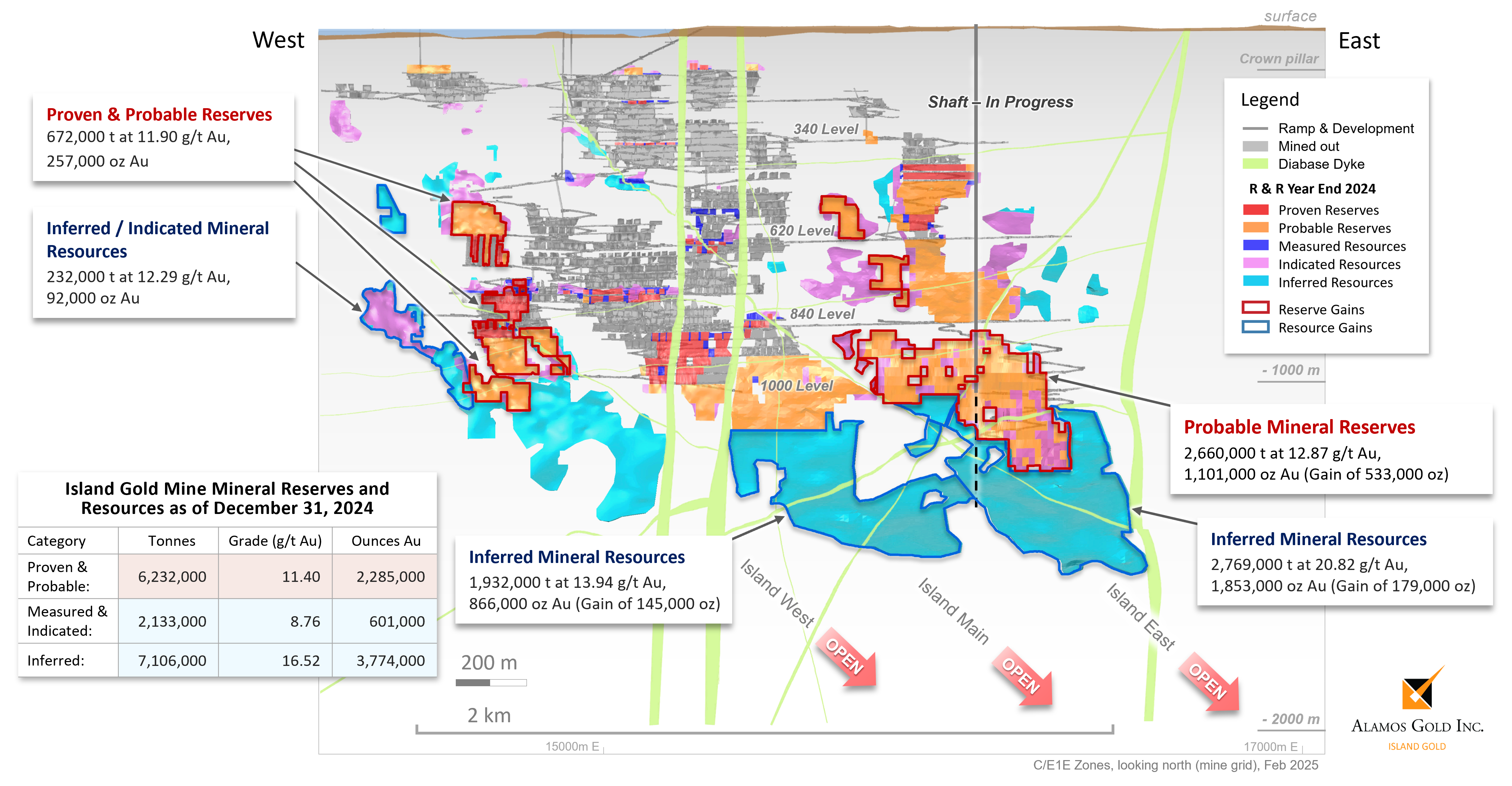

The increase was driven by the conversion of existing Mineral Resources and the discovery of new Mineral Reserves across the main structure. The biggest contributor to the increase was the addition of 533,000 ounces in the middle portion of Island East within a large Mineral Reserve block that now contains 1.1 million ounces grading 12.87 g/t Au (2.7 mt) (see Figure 1).

This large Mineral Reserve block is located above an even larger and substantially higher grade Inferred Mineral Resource block in the lower portion of Island East which contains 1.9 million ounces, grading 20.82 g/t Au (2.8 mt). As exploration drifts are established at depth providing access to drill from underground at these levels, the conversion of significantly higher-grade Mineral Resources is expected to drive further growth in higher-grade Mineral Reserves. This is supported by a conversion rate of Inferred Mineral Resource to Reserves which has averaged more than 90% since the acquisition of Island Gold in 2017.

Measured and Indicated Mineral Resources decreased 115,000 ounces to 601,000 ounces with grades increasing slightly to 8.76 g/t Au, reflecting the conversion to Mineral Reserves. Inferred Mineral Resources increased 2% to 3.8 million ounces, with additions across the main structure, as well as within various hanging wall and footwall zones, more than replacing the Mineral Resources converted to Reserves.

These additions were also at significantly higher grades driving a 13% increase in the Inferred Mineral Resource grade to 16.52 g/t Au. Consistent with the increase in Mineral Reserve grades, a key driver of the increase in Mineral Resource grades has been significantly higher-grade additions in the lower portions of Island East and Island Main where 324,000 ounces were added. With the deposit open laterally and at depth, and some of best intercepts ever drilled at Island Gold located within the lower portion of Island East, there is excellent potential for further growth in Mineral Reserves and Resources.

The discovery cost of the high-grade Mineral Resource additions averaged an attractive $13 per ounce in 2024, and $13 per ounce over the past five years.

A total of $27 million is budgeted for exploration at the Island Gold District in 2025, up from $20 million spent in 2024. The exploration program will build on the success from 2024, with high-grade gold mineralization extended across the Island Gold deposit, as well as within multiple structures within the hanging wall and footwall.

A total of 41,500 metres ("m") of underground drilling is planned in 2025 with a focus on defining new Mineral Reserves and Resources in proximity to existing production horizons and infrastructure. This includes drilling across the strike extent of the main Island Gold deposit (E1E and C-Zones), as well as within a growing number of newly defined hanging-wall and footwall zones.

Additionally, 18,000 m of surface exploration drilling has been budgeted targeting the area between the Island Gold and Magino deposits, as well as the down-plunge extension of the Island Gold deposit, below a depth of 1,500 m. Included within sustaining capital, 30,800 m of underground delineation drilling is planned and focused on the conversion of the large Mineral Resource base to Mineral Reserves.

The regional exploration program at the Island Gold District includes 10,000 m of surface drilling, consistent with the 2024 program. The focus will be following up on high-grade mineralization intersected at the Cline and Edwards deposits located approximately seven kilometres (“km”) northeast of the Island Gold mine.

Drilling will also be completed at the Island Gold North Shear target, and to the east and along strike from the Island Gold mine to test the extension of the E1E-zone. Field work in 2025 will include till sampling, geological mapping, prospecting, and trenching at several regional targets. A comprehensive data compilation project will also continue into 2025 across the large 60,000 hectare land package in support of future exploration targeting.

Significant growth to be incorporated into Island Gold District mine plan

The Phase 3+ Expansion Study (“Phase 3+ Study”) released in June 2022 was based on Mineral Reserves and Resources at the end of 2021, which totaled 5.1 million ounces. Since the release of the Phase 3+ Study, ongoing exploration success has driven a substantial increase in Mineral Reserves, Resources, and grades with the details as follows:

- 31%, or 1.6 million ounce increase in combined Mineral Reserves and Resources to total 6.7 million ounces

- 71% increase in Mineral Reserves to 2.3 million ounces, with a 13% increase in grades to 11.40 g/t Au

- 9% increase in Inferred Mineral Resources to 3.8 million ounces, with a 22% increase in grades to 16.52 g/t Au

- 19 year mine-life based on the same Mineral Resource conversion rate as utilized in the Phase 3+ Study

This growth will be incorporated into an Island Gold District mine plan to be released mid-2025, and an Expansion Study to be completed in the fourth quarter. Given the substantial increase in grades at Island Gold since the Phase 3+ Study, this is expected to support higher average annual gold production from Island Gold over the longer term. The updated mine plan and Expansion Study will incorporate updated Reserves and Resources at Island Gold and Magino, with the combined operations sharing a centralized mill at Magino.

Magino

Magino’s Mineral Reserves total 2.0 million ounces at an average grade of 0.91 g/t Au. This is the first Mineral Reserve estimate for Magino published by Alamos following its acquisition in July 2024. This represents a decrease from the 2.3 million ounces grading 1.16 g/t Au reported by the previous owner reflecting more realistic assumptions, including lower capping factors, increased dilution, and limiting areas of influence around higher grade intercepts.

The updated estimate is consistent with the internally modelled estimate completed by Alamos prior to the acquisition of Argonaut. Grades mined to date have been consistent with Alamos’ updated block model and Mineral Reserve estimate.

Measured and Indicated Mineral Resources total 1.9 million ounces, grading 0.94 g/t Au, representing 10% lower ounces at 32% higher grades compared with the estimate reported by the previous owner. Inferred Mineral Resources total 1.2 million ounces, grading 0.91 g/t Au, a 60% increase in ounces and 21% increase in grades relative to the previous owner’s estimate.

The large Mineral Resource base is contained within a larger Resource pit below and surrounding the existing Reserve pit. Through additional drilling, and an $1,800 per ounce of gold price assumption, a significant portion of these Mineral Resources are expected to convert to Mineral Reserves.

Magino’s exploration program has been incorporated into the broader Island Gold District budget which totals $27 million. The focus in 2025 will be expanding mineralization to the east of the pit which was previously constrained by the border with Island Gold prior to the acquisition.

Included within 2025 sustaining capital guidance is 18,000 m of surface delineation drilling planned at Magino. The focus of the delineation drilling is the conversion of the large Mineral Resource base to Mineral Reserves.

Mulatos District

Total Mulatos District Mineral Reserves decreased slightly (61,000 oz) to 1.4 million ounces, with depletion at La Yaqui Grande, largely offset by an increase at the PDA underground deposit. Grades increased 16% to 3.14 g/t Au reflecting a growing proportion of higher-grade Mineral Reserves from PDA.

Ongoing exploration success at PDA drove a 9% increase in Mineral Reserves to 1.1 million ounces, with grades largely unchanged at 5.45 g/t Au. PDA is a higher-grade underground deposit located adjacent to the main Mulatos pit. The results of a positive internal economic study were announced in September 2024 and highlighted an attractive, low-cost, high-return project. With the amendment to the environmental permit received earlier this year, construction activities are expected to begin ramping up towards the middle of the year with first production anticipated mid-2027. The increase in Mineral Reserves has extended the Reserve life of PDA to nine years, from eight previously, with significant exploration upside potential.

The planned addition of a mill to process higher-grade sulphides has created new opportunities for growth within the Mulatos District. This includes Cerro Pelon, where drilling in 2024 followed up on wide high-grade underground oxide and sulphide intersections previously drilled below the pit. The 2024 program was successful in defining an initial Measured and Indicated Mineral Resource at Cerro Pelon totalling 104,000 ounces, grading 4.49 g/t Au. Cerro Pelon remains open in multiple directions and will be a focus of the 2025 exploration program as a significant opportunity for further growth. As the deposit is located within trucking distance of the planned PDA mill, this represents upside to the PDA project.

Total Measured and Indicated Mineral Resources in the Mulatos District increased 17% from the end of 2023 to 0.7 million ounces, with grades increasing 7% to 1.61 g/t Au, reflecting the initial Mineral Resource at Cerro Pelon. Inferred Mineral Resources increased to 0.1 million ounces grading 1.34 g/t Au.

A total of $19 million is budgeted at Mulatos for exploration in 2025, down slightly from $21 million spent in 2024. The near-mine and regional drilling program is expected to total 45,000 m. This includes 15,000 m of surface exploration drilling at the GAP-Victor and PDA Extension targets at PDA, and 20,000 m planned at Cerro Pelon.

The regional exploration program includes 10,000 m of drilling focused on advanced and greenfield targets within the Mulatos District.

Young-Davidson

Mineral Reserves at Young-Davidson decreased 7% to 3.0 million ounces at slightly lower grades of 2.26 g/t Au, primarily reflecting mining depletion. Measured and Indicated Mineral Resources increased 5% to 1.2 million ounces grading 2.87 g/t Au. Inferred Mineral Resources also increased slightly to 0.2 million ounces grading 3.22 g/t Au.

The 2024 drill program was focused on expanding gold mineralization within the Young-Davidson syenite, which hosts the majority of Mineral Reserves and Resources, as well as defining further higher-grade mineralization within the hanging wall. The program was successful in expanding gold mineralization within the syenite across multiple levels. Drilling completed in the hanging wall of the deposit from the 9620 level was also successful in defining and expanding on a new style of gold mineralization within hanging wall lithologies, including conglomerates, volcanics, and syenite intrusions.

This included defining a new Inferred Mineral Resource block in the hanging wall, containing 70,000 ounces, grading 3.40 g/t Au. This Mineral Resource block is located within a new style of higher-grade mineralization, in close proximity to the existing mid-mine infrastructure. Expanding higher-grade mineralization in this area will be a key focus on the 2025 exploration program with grades intersected to date well above the Mineral Reserve grade.

A total of $11 million is budgeted for exploration at Young-Davidson in 2025, an increase from $9 million spent in 2024. This includes 25,600 m of underground exploration drilling focused on extending mineralization in the syenite, and continuing to evaluate and expand on the newly defined hanging wall zones. Geological modelling including historic core relogging and sampling, structural analysis, and hyperspectral scanning is underway to refine the controls of the high-grade gold mineralization in the hanging wall and to plan additional drill platforms to continue to evaluate the geometry and extent of the mineralization.

To support the program, 500 m of underground exploration development is planned, including 400 m to establish a hanging wall exploration drift to the south, from the 9620-level. This will allow for drill platforms with more optimal locations and orientations to test the higher-grade mineralization discovered in the hanging wall.

The regional program includes 6,000 m of drilling focused on evaluating the Otisse NE target, located approximately 3 km northeast of Young-Davidson. A comprehensive data compilation project will also commence in 2025 for the Wydee and Matachewan projects, which were acquired in the third quarter of 2024, and located to the west and east of Young-Davidson, respectively.

Based on underground mining rates of 8,000 tonnes per day, the Mineral Reserve life of the Young-Davidson mine is 14 years as of December 31, 2024. Young-Davidson has maintained at least a 13-year Mineral Reserve life since 2011, reflecting a strong track record of Mineral Resource conversion. With the deposit open at depth and to the west, and with new zones being defined in the hanging wall, there is excellent potential to further extend its Mineral Reserve life.

Lynn Lake District

Total Mineral Reserves for the Lynn Lake District increased 42% to 3.3 million ounces, with grades decreasing 15% to 1.29 g/t Au. This was driven by the successful conversion of Mineral Resources to Reserves at Burnt Timber and Linkwood resulting in an initial Mineral Reserve of 0.9 million ounces grading 0.95 g/t Au.

Mineral Reserves at the Lynn Lake project, which consists of the Gordon and MacLellan deposits, also increased slightly to 2.4 million ounces at slightly lower grades of 1.50 g/t Au.

Burnt Timber and Linkwood are satellite deposits to the Lynn Lake project and are expected to provide additional mill feed. An internal economic study on Burnt Timber and Linkwood was released last week, outlining an attractive, low capital, high-return project. Burnt Timber and Linkwood are expected to extend the mine life of the Lynn Lake project, increase longer term rates of production, and enhance the overall economics. The combined mine life of the Lynn Lake project is expected to increase to 27 years, up from the 17 years outlined in the Lynn Lake Feasibility Study.

Measured and Indicated Mineral Resources increased to 0.6 million ounces reflecting the conversion of Inferred Mineral Resources at Burnt Timber and Linkwood. Inferred Mineral Resources decreased 90% to 0.2 million ounces driven by the conversion of Burnt Timber and Linkwood Inferred Mineral Resources to Mineral Reserves.

A total of $4 million is budgeted for exploration at the Lynn Lake project in 2025, down from $7 million spent in 2024, with the focus shifting to the ramp up of construction activities. The exploration program includes 7,000 metres of drilling focused on expanding Mineral Resources at the Burnt Timber and Linkwood deposits.

The Company will also continue prioritizing a pipeline of prospective exploration targets within the 58,000 hectare Lynn Lake Property.

Kirazlı, Ağı Dağı, Çamyurt and Quartz Mountain

Mineral Reserves and Resources for the Kirazlı, Ağı Dağı, Çamyurt , Golden Arrow, and Quartz Mountain projects are unchanged from a year ago.

Qualified Persons

Chris Bostwick, FAusIMM, Alamos Gold’s Senior Vice President, Technical Services, has reviewed and approved the scientific and technical information contained in this news release. Chris Bostwick is a Qualified Person within the meaning of Canadian Securities Administrator’s National Instrument 43-101 (“NI 43-101”). The Qualified Persons for the National Instrument 43-101 compliant Mineral Reserve and Resource estimates are detailed in the following table.

| Mineral Resources QP | Company | Project |

| Jeffrey Volk, CPG, FAusIMM | Director - Reserves and Resources, Alamos Gold Inc. |

Young-Davidson, Lynn Lake, Golden Arrow, Magino |

| Tyler Poulin, P.Geo | Geology Superintendent - Island Gold, Alamos Gold Inc. | Island Gold |

| Marc Jutras, P.Eng | Principal, Ginto Consulting Inc. | Mulatos Pits, PDA, La Yaqui Grande, Cerro Peon, Carricito, Ağı Dağı, Kirazli, Çamyurt, Quartz Mountain |

| Mineral Reserves QP | Company | Project |

| Chris Bostwick, FAusIMM | SVP Technical Services, Alamos Gold Inc. | Young-Davidson, Lynn Lake, PDA, Magino |

| Nathan Bourgeault, P.Eng | Chief Mine Engineer - Island Gold, Alamos Gold Inc. | Island Gold |

| Herb Welhener, SME-QP | VP, Independent Mining Consultants Inc. | La Yaqui Grande, Ağı Dağı, Kirazli |

With the exception of Mr. Volk, Mr. Bostwick, Mr. Poulin, and Mr. Bourgeault each of the foregoing individuals are independent of Alamos Gold.

About Alamos

Alamos is a Canadian-based intermediate gold producer with diversified production from three operating mines in North America. This includes the Island Gold District and the Young-Davidson mine in northern Ontario, Canada, and the Mulatos District in Sonora State, Mexico. Additionally, the Company has a significant portfolio of development stage projects, including the Phase 3+ Expansion at Island Gold, and the Lynn Lake project in Manitoba, Canada. Alamos employs more than 2,400 people and is committed to the highest standards of sustainable development. The Company’s shares are traded on the TSX and NYSE under the symbol “AGI”.

FOR FURTHER INFORMATION, PLEASE CONTACT:

| Scott K. Parsons |

| Senior Vice President, Corporate Development & Investor Relations |

| (416) 368-9932 x 5439 |

| Khalid Elhaj |

| Vice President, Business Development & Investor Relations |

| (416) 368-9932 x 5427 |

| ir@alamosgold.com |

The TSX and NYSE have not reviewed and do not accept responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

This news release contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities laws. All statements in this news release other than statements of historical fact, which address events, results, outcomes or developments that Alamos expects to occur are, or may be deemed to be, forward-looking statements. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as "expect", “anticipate”, :assume”, "plan", “continue”, “ongoing”, “trend”, "estimate", “target”, “budget”, “prospective” or “potential” or variations of such words and phrases and similar expressions or statements that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved or the negative connotation of such terms. Forward-looking statements contained in this news release are based on expectations, estimates and projections as at the date of this news release.

Forward-looking statements in this news release include, without limitation, information, expectations and guidance as to strategy, plans, future financial and operating performance, such as statements, expectations and guidance regarding: planned exploration programs, focuses, targets and budgets; exploration potential; potential drilling results and related expectations; expected underground mining rates; gold production and production potential, including expected increases in gold production from Island Gold over the longer term; sustaining capital, costs and expenditures; project economics; value of operations; gold price assumptions; ongoing construction of the Phase 3+ Expansion Project at Island Gold; construction of the Lynn Lake Project; Construction of the Puerto Del Aire Project and timing of initial production; Island Gold District Life of Mine Plan and Expansion Study; deposits at Burnt Timber and Linkwood and their intended incorporation into the Lynn Lake Project as high-return satellite deposits; initial Mineral Resource at Cerro Pelon underground; potential mineralization; projected ore grades; Mineral Resource conversion rates; mine life; Reserve life; and other information that is based on forecasts and projections of future operational, geological or financial results, estimates of amounts not yet determinable and assumptions of management.

A Mineral Resource that is classified as "Inferred" or "Indicated" has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an "Indicated Mineral Resource" or "Inferred Mineral Resource" will ever be upgraded to a higher category of Mineral Resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into Proven and Probable Mineral Reserves.

Alamos cautions that forward-looking statements are necessarily based upon several factors and assumptions that, while considered reasonable by management at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements, and undue reliance should not be placed on such statements and information.

These factors and assumptions include, but are not limited to: the actual results of current exploration activities; conclusions of economic and geological evaluations; changes in project parameters as plans continue to be refined; operations may be exposed to serious illness, disease, epidemics and/or pandemics; the impact of any illness, disease, epidemic or pandemic on the broader market and the duration of any regulatory response; provincial and federal orders or mandates (including with respect to mining operations generally or auxiliary businesses or services required for the Company’s operations) in Canada, Mexico, the United States and Türkiye; changes in national and local government legislation, controls or regulations; failure to comply with environmental and health and safety laws and regulations; labour and contractor availability (and being able to secure the same on favourable terms); ability to sell or deliver gold doré bars; disruptions in the maintenance or provision of required infrastructure and information technology systems; fluctuations in the price of gold or certain other commodities such as, diesel fuel, natural gas, and electricity; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges and changes to production estimates (which assume accuracy of projected ore grade, mining rates, recovery timing and recovery rate estimates and may be impacted by unscheduled maintenance); changes in foreign exchange rates (particularly the Canadian dollar, U.S. dollar, Mexican peso and Turkish Lira); the impact of inflation, the implementation of tariffs, trade barriers and/or regulatory costs; employee and community relations; litigation and administrative proceedings (including but not limited to the investment treaty claim announced on April 20, 2021 against the Republic of Türkiye by the Company’s wholly-owned Netherlands subsidiaries, Alamos Gold Holdings Coöperatief U.A. and Alamos Gold Holdings B.V. and the application for judicial review of the positive Decision Statement issued by the Ministry of Environment and Climate Change Canada commenced by the Mathias Colomb Cree Nation (MCCN) in respect of the Lynn Lake Project and the MCCN’s corresponding internal appeal of the Environment Act Licences issued by the Province of Manitoba for the project) and any resulting court, regulatory or arbitral decisions; disruptions affecting operations; availability of and increased costs associated with mining inputs and labour; risks associated with the start-up of new mines; delays with the Phase 3+ Expansion Project at the Island Gold mine; delays in the development or updating of mine plans; delays in the construction of the Lynn Lake Project or the Puerto Del Aire Project; changes that may be required to the intended method of accessing and mining the deposit at Puerto Del Aire and Lynn Lake projects; expectations with respect to the Golden Arrow open pit project providing supplemental mill feed to the mill at the Young-Davidson mine not coming to fruition; inherent risks and hazards associated with mining and mineral processing including environmental hazards, industrial accidents, unusual or unexpected formations, pressures and cave-ins; the risk that the Company’s mines may not perform as planned; uncertainty with the Company's ability to secure additional capital to execute its business plans; the speculative nature of mineral exploration and development; risks in obtaining and maintaining necessary licenses, permits and authorizations for the Company’s development stage and operating assets; risk that required amendments to existing permits for the Lynn Lake project to accommodate the Burnt Timber and Linkwood deposits may not be obtained;, contests over title to properties; expropriation or nationalization of property; political or economic developments in Canada, Mexico, the United States, Türkiye and other jurisdictions in which the Company may carry on business in the future; increased costs and risks related to the potential impact of climate change; the costs and timing of construction and development of new deposits; effects of construction decisions, risk of loss due to sabotage, protests and other civil disturbances; the impact of global liquidity and credit availability and the values of assets and liabilities based on projected future cash flows; and business opportunities that may be pursued by the Company.

The litigation against the Republic of Türkiye, described above, results from the actions of the Turkish government in respect of the Company’s projects in the Republic of Türkiye. Such litigation is a mitigation effort and may not be effective or successful. If unsuccessful, the Company’s projects in Türkiye may be subject to resource nationalism and further expropriation; the Company may lose any remaining value of its assets and gold mining projects in Türkiye and its ability to operate in Türkiye or to put any of the Kirazli, Aği Daği or Çamyurt sites into production, resulting in the Company removing those three projects from its Total Mineral Reserves and Resources. Even if the litigation is successful, there is no certainty as to the quantum of any damages award or recovery of all, or any, legal costs. Any resumption of activities in Türkiye, or even retaining control of its assets and gold mining projects in Türkiye can only result from agreement with the Turkish government. The investment treaty claim described above may have an impact on foreign direct investment in the Republic of Türkiye which may result in changes to the Turkish economy, including but not limited to high rates of inflation and fluctuation in the Turkish Lira which may also affect the Company’s relationship with the Turkish government, the Company’s ability to effectively operate in Türkiye, and which may have a negative effect on overall anticipated project values.

For a more detailed discussion of such risks and other factors that may affect the Company's ability to achieve the expectations set forth in the forward-looking statements contained in this news release, see the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, available on the SEDAR+ website at www.sedarplus.ca or on EDGAR at www.sec.gov. The foregoing should be reviewed in conjunction with the information and risk factors and assumptions found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

Note to U.S. Investors – Mineral Reserve and Resource Estimates

Unless otherwise indicated, all Mineral Resource and Mineral Reserve estimates included in this news release have been prepared in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) - CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended (the “CIM Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Mining disclosure in the United States was previously required to comply with SEC Industry Guide 7 (“SEC Industry Guide 7”) under the United States Securities Exchange Act of 1934, as amended. The U.S. Securities and Exchange Commission (the “SEC”) has adopted final rules, to replace SEC Industry Guide 7 with new mining disclosure rules under sub-part 1300 of Regulation S-K of the U.S. Securities Act (“Regulation S-K 1300”) which became mandatory for U.S. reporting companies beginning with the first fiscal year commencing on or after January 1, 2021. Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Investors are cautioned that while the above terms are “substantially similar” to CIM Definitions, there are differences in the definitions under Regulation S-K 1300 and the CIM Standards. Accordingly, there is no assurance any Mineral Reserves or Mineral Resources that the Company may report as “Proven Mineral Reserves”, “Probable Mineral Reserves”, “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under NI 43-101 would be the same had the Company prepared the Mineral Reserve or mineral resource estimates under the standards adopted under Regulation S-K 1300. U.S. investors are also cautioned that while the SEC recognizes “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” under Regulation S-K 1300, investors should not assume that any part or all of the mineralization in these categories will ever be converted into a higher category of Mineral Resources or into Mineral Reserves. Mineralization described using these terms has a greater degree of uncertainty as to its existence and feasibility than mineralization that has been characterized as Reserves. Accordingly, investors are cautioned not to assume that any Measured Mineral Resources, Indicated Mineral Resources, or Inferred Mineral Resources that the Company reports are or will be economically or legally mineable.

| Table 1: Total Proven and Probable Mineral Reserves as of December 31, 2024 | |||||||||

| PROVEN AND PROBABLE GOLD RESERVES (as at December 31, 2024) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |

| Island Gold | 727 | 12.74 | 298 | 5,505 | 11.23 | 1,987 | 6,232 | 11.40 | 2,285 |

| Magino | 19,684 | 0.89 | 561 | 48,715 | 0.92 | 1,447 | 68,400 | 0.91 | 2,008 |

| Young-Davidson | 28,469 | 2.28 | 2,087 | 13,287 | 2.21 | 943 | 41,756 | 2.26 | 3,030 |

| La Yaqui Grande | 190 | 0. 90 | 5 | 7,520 | 1.35 | 326 | 7,710 | 1.34 | 331 |

| Puerto Del Aire | 946 | 4.78 | 145 | 5,104 | 5.57 | 914 | 6,050 | 5.45 | 1,060 |

| Total Mulatos | 1,136 | 4.13 | 151 | 12,624 | 3.06 | 1,240 | 13,760 | 3.14 | 1,391 |

| MacLellan | 16,395 | 1.67 | 881 | 22,985 | 1.12 | 830 | 39,738 | 1.35 | 1,711 |

| Gordon | 4,211 | 2.34 | 317 | 5,794 | 1.90 | 354 | 10,006 | 2.09 | 671 |

| Burnt Timber | 2,088 | 1.48 | 99 | 12,265 | 0.94 | 369 | 14,352 | 1.02 | 469 |

| Linkwood | 814 | 0.94 | 25 | 15,504 | 0.90 | 447 | 16,318 | 0.90 | 472 |

| Total Lynn Lake | 23,507 | 1.75 | 1,322 | 56,548 | 1.10 | 2,000 | 80,056 | 1.29 | 3,322 |

| Ağı Dağı | 1,450 | 0.76 | 36 | 52,911 | 0.66 | 1,130 | 54,361 | 0.67 | 1,166 |

| Kirazlı | 670 | 1.15 | 25 | 33,191 | 0.68 | 727 | 33,861 | 0.69 | 752 |

| Total Türkiye | 2,120 | 0.89 | 61 | 86,102 | 0.67 | 1,857 | 88,222 | 0.68 | 1,918 |

| Alamos - Total | 75,643 | 1.84 | 4,479 | 222,781 | 1.32 | 9,475 | 298,425 | 1.45 | 13,954 |

| PROVEN AND PROBABLE SILVER MINERAL RESERVES (as at December 31, 2024) | |||||||||

| Proven Reserves | Probable Reserves | Total Proven and Probable | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | - | - | - | 7,520 | 17.18 | 4,154 | 7,520 | 17.18 | 4,154 |

| Puerto Del Aire | 946 | 13.31 | 405 | 5,104 | 6.60 | 1,083 | 6,050 | 7.65 | 1,487 |

| MacLellan | 16,395 | 5.32 | 2,802 | 22,985 | 3.55 | 2,621 | 39,379 | 4.28 | 5,423 |

| Ağı Dağı | 1,450 | 6.22 | 290 | 52,911 | 5.39 | 9,169 | 54,361 | 5.41 | 9,459 |

| Kirazlı | 670 | 16.94 | 365 | 33,191 | 9.27 | 9,892 | 33,861 | 9.42 | 10,257 |

| Alamos - Total | 19,461 | 6.17 | 3,861 | 121,711 | 6.88 | 26,919 | 141,171 | 6.78 | 30,780 |

| Table 2: Project Life-of-Mine Mineral Reserve Waste-to-Ore Ratios as of December 31, 2024 | |||

| Project | Waste-to-Ore Ratio | ||

| Magino | 4.0 | ||

| La Yaqui Grande Pit | 4.1 | ||

| Ağı Dağı Pits | 1.0 | ||

| Kirazlı Pit | 1.5 | ||

| Lynn Lake Pits | 4.9 | ||

| Table 3: Total Measured and Indicated Mineral Resources as of December 31, 2024 | |||||||||

| MEASURED AND INDICATED GOLD MINERAL RESOURCES (as at December 31, 2024) | |||||||||

| Measured Resources | Indicated Resources | Total Measured and Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | (000's) | (g/t Au) | (000's) | |

| Island Gold | 235 | 10.96 | 83 | 1,898 | 8.49 | 518 | 2,113 | 8.76 | 601 |

| Magino | 5,579 | 1.00 | 179 | 57,110 | 0.94 | 1,726 | 62,689 | 0.94 | 1,905 |

| Young-Davidson - Surface | 496 | 1.13 | 18 | 1,242 | 1.28 | 51 | 1,739 | 1.24 | 69 |

| Young-Davidson - Underground | 7,130 | 3.33 | 762 | 3,984 | 2.77 | 355 | 11,114 | 3.13 | 1,117 |

| Total Young-Davidson | 7,627 | 3.18 | 780 | 5,226 | 2.41 | 406 | 12,825 | 2.87 | 1,186 |

| Golden Arrow | 3,626 | 1.26 | 147 | 2,816 | 1.09 | 99 | 6,442 | 1.19 | 246 |

| Mulatos | 700 | 1.01 | 23 | 6,072 | 0.98 | 191 | 6,772 | 0.98 | 214 |

| La Yaqui Grande | - | - | - | 1,523 | 0.78 | 38 | 1,523 | 0.78 | 38 |

| Puerto Del Aire | 364 | 3.32 | 39 | 2,039 | 3.52 | 230 | 2,403 | 3.49 | 269 |

| Cerro Pelon | 180 | 5.08 | 29 | 540 | 4.29 | 74 | 720 | 4.49 | 104 |

| Carricito | 58 | 0.82 | 2 | 1,297 | 0.82 | 34 | 1,355 | 0.83 | 36 |

| Total Mulatos | 1,302 | 2.23 | 93 | 11,470 | 1.54 | 568 | 12,772 | 1.61 | 661 |

| MacLellan | 808 | 1.59 | 41 | 3,714 | 1.44 | 173 | 4,523 | 1.47 | 214 |

| Gordon | 194 | 2.62 | 16 | 900 | 2.41 | 70 | 1,093 | 2.45 | 86 |

| Burnt Timber | 107 | 3.27 | 11 | 6,183 | 0.84 | 166 | 6,290 | 0.88 | 178 |

| Linkwood | 7 | 1.12 | - | 4,276 | 0.79 | 109 | 4,283 | 0.80 | 110 |

| Total Lynn Lake | 1,116 | 1.93 | 69 | 15,073 | 1.07 | 518 | 16,189 | 1.13 | 587 |

| Ağı Dağı | 553 | 0.44 | 8 | 34,334 | 0.46 | 510 | 34,887 | 0.46 | 518 |

| Kirazlı | - | - | - | 3,056 | 0.42 | 42 | 3,056 | 0.43 | 42 |

| Çamyurt | 513 | 1.00 | 16 | 17,208 | 0.89 | 492 | 17,721 | 0.89 | 508 |

| Total Türkiye | 1,066 | 0.70 | 24 | 54,598 | 0.59 | 1,044 | 55,664 | 0.60 | 1,068 |

| Quartz Mountain | 214 | 0.95 | 7 | 11,942 | 0.87 | 333 | 12,156 | 0.87 | 339 |

| Alamos - Total | 20,764 | 2.07 | 1,382 | 160,133 | 1.01 | 5,211 | 180,897 | 1.13 | 6,594 |

| MEASURED AND INDICATED SILVER MINERAL RESOURCES (as at December 31, 2024) | |||||||||

| Measured Resources | Indicated Resources | Total Measured and Indicated | |||||||

| Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | Tonnes | Grade | Ounces | |

| (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | (000's) | (g/t Ag) | (000's) | |

| La Yaqui Grande | - | - | - | 1,523 | 10.09 | 494 | 1,523 | 10.09 | 494 |

| Puerto Del Aire | 364 | 14.69 | 172 | 2,039 | 9.16 | 601 | 2,403 | 10.00 | 772 |

| Cerro Pelon | 180 | 87.96 | 509 | 540 | 52.89 | 918 | 720 | 61.67 | 1,427 |

| MacLellan | 808 | 2.85 | 74 | 3,714 | 3.25 | 388 | 4,523 | 3.18 | 462 |

| Ağı Dağı | 553 | 1.59 | 28 | 34,334 | 2.19 | 2,417 | 34,887 | 2.18 | 2,445 |

| Kirazlı | - | - | - | 3,056 | 2.71 | 266 | 3,056 | 2.71 | 266 |

| Çamyurt | 513 | 5.63 | 93 | 17,208 | 6.15 | 3,404 | 17,721 | 6.14 | 3,497 |

| Alamos - Total | 2,418 | 11.27 | 876 | 62,414 | 4.23 | 8,488 | 64,832 | 4.49 | 9,364 |

|

Table 4: Total Inferred Mineral Resources as of December 31, 2024 |

|||||

|

INFERRED GOLD MINERAL RESOURCES (as at December 31, 2024) |

|||||

| Tonnes | Grade | Ounces | |||

| (000's) | (g/t Au) | (000's) | |||

| Island Gold | 7,106 | 16.52 | 3,774 | ||

| Magino | 40,383 | 0.91 | 1,177 | ||

| Young-Davidson - Surface | 31 | 0.99 | 1 | ||

| Young-Davidson - Underground | 1,880 | 3.25 | 197 | ||

| Total Young-Davidson | 1,911 | 3.22 | 198 | ||

| Golden Arrow | 2,028 | 1.07 | 70 | ||

| Mulatos | 641 | 0.91 | 19 | ||

| La Yaqui Grande | 74 | 1.74 | 4 | ||

| Puerto Del Aire | 281 | 4.07 | 37 | ||

| Carricito | 900 | 0.74 | 22 | ||

| Total Mulatos | 1,896 | 1.34 | 82 | ||

| MacLellan | 4,591 | 0.90 | 133 | ||

| Gordon | 166 | 1.39 | 7 | ||

| Burnt Timber | 548 | 1.04 | 18 | ||

| Linkwood | 378 | 1.04 | 13 | ||

| Total Lynn Lake | 5,682 | 0.94 | 171 | ||

| Ağı Dağı | 16,760 | 0.46 | 245 | ||

| Kirazlı | 7,694 | 0.61 | 152 | ||

| Çamyurt | 2,791 | 0.95 | 85 | ||

| Total Türkiye | 27,245 | 0.55 | 482 | ||

| Quartz Mountain | 39,205 | 0.91 | 1,147 | ||

| Alamos - Total | 125,455 | 1.76 | 7,100 | ||

|

INFERRED SILVER MINERAL RESOURCES (as at December 31, 2024) |

|||||

| Tonnes | Grade | Ounces | |||

| (000's) | (g/t Ag) | (000's) | |||

| La Yaqui Grande | 74 | 3.55 | 8 | ||

| Puerto Del Aire | 281 | 11.30 | 102 | ||

| MacLellan | 4,591 | 1.49 | 219 | ||

| Ağı Dağı | 16,760 | 2.85 | 1,536 | ||

| Kirazlı | 7,694 | 8.71 | 2,155 | ||

| Çamyurt | 2,791 | 5.77 | 518 | ||

| Alamos - Total | 32,191 | 4.39 | 4,538 | ||

Notes to Mineral Reserve and Resource Tables:

- The Company’s Mineral Reserves and Mineral Resources as at December 31, 2024 are classified in accordance with the Canadian Institute of Mining Metallurgy and Petroleum’s “CIM Standards on Mineral Resources and Reserves, Definition and Guidelines” as per Canadian Securities Administrator’s NI 43-101 requirements.

- Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability.

- Mineral Resources are exclusive of Mineral Reserves.

- Mineral Reserve cut-off grade for the La Yaqui Pit, the Kirazlı Pit and the Ağı Dağı Pit are determined as a net of process value of $0.10 per tonne for each model block.

- All Measured, Indicated and Inferred open pit Mineral Resources are pit constrained.

- With the exceptions noted following, Mineral Reserve estimates assumed a gold price of $1,600 per ounce and Mineral Resource estimates assumed a gold price of $1,800 per ounce.

- Metal prices, cut-off grades and metallurgical recoveries are set out in the table below.

| Mineral Resources | Mineral Reserves | |||||||

| Gold Price | Cut-off | Gold Price | Cut-off | Met Recovery | ||||

| Island Gold | $1,800 | 3.75 | $1,600 | 2.95-3.78 | 97.0% | |||

| Magino | $1,800 | 0.27 | $1,600 | 0.34 | 90-93% | |||

| Young-Davidson - Surface | $1,400 | 0.5 | n/a | n/a | n/a | |||

| Young-Davidson - Underground | $1,800 | 1.39 | $1,600 | 1.53 | 92% | |||

| Golden Arrow | $1,600 | 0.64 | n/a | n/a | 91% | |||

| Mulatos: | ||||||||

| Mulatos Main Open Pit | $1,800 | 0.5 | n/a | n/a | n/a | |||

| PDA Underground | $1,800 | 2.5 | $1,600 | 3.0 | 85% | |||

| La Yaqui Grande | $1,800 | 0.3 | $1,600 | see notes | 75% | |||

| Cerro Pelon | $1,800 | 2.5 | n/a | n/a | n/a | |||

| Carricito | $1,400 | 0.3 | n/a | n/a | n/a | |||

| Lynn Lake - MacLellan | $1,800 | 0.32 | $1,600 | 0.36 | 91-92% | |||

| Lynn Lake - Gordon | $1,800 | 0.44 | $1,600 | 0.50 | 92.4% | |||

| Lynn Lake – Burnt Timber | $1,800 | 0.39 | $1,600 | 0.44 | 91-92% | |||

| Lynn Lake – Linkwood | $1,800 | 0.2 | $1,600 | 0.44 | 91-92% | |||

| Ağı Dağı | $1,400 | 0.2 | $1,250 | see notes | 80% | |||

| Kirazli | $1,400 | 0.2 | $1,250 | see notes | 81% | |||

| Çamyurt | $1,400 | 0.2 | n/a | n/a | 78% | |||

Figure 1: Island Gold Mine Main Structure (C/E1E Zone) Longitudinal – 2024 Mineral Reserve & Resource Additions

Images accompanying this announcement is available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/66bb8465-21bc-4b1e-a7e1-49c004da563b

https://www.globenewswire.com/NewsRoom/AttachmentNg/894fa21d-7ead-470f-9d68-3426db2e6504

https://www.globenewswire.com/NewsRoom/AttachmentNg/264f7a0a-dfb2-44b6-b11e-7b201503da4b

https://www.globenewswire.com/NewsRoom/AttachmentNg/b685ceba-ebf2-4c7d-b814-368f1e0336b5

Global Mineral Reserves (000 oz) - Six Consecutive Years of Growth

Global Mineral Reserves (000 oz) - Six Consecutive Years of Growth

2024 Mineral Reserve Growth (000 oz)

2024 Mineral Reserve Growth (000 oz)

Island Gold Mineral Reserve & Resource Growth

Island Gold Mineral Reserve & Resource Growth

Figure 1 Island Gold Main Structure C E1E Longitudinal - 2024 Mineral R&R Additions

Figure 1 Island Gold Main Structure C E1E Longitudinal - 2024 Mineral R&R Additions

Distribution channels: Mining Industry ...

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release